Digital Transformation Trends for Financial Services

Time to read: 6 minutes

The drive towards digital transformation is far from complete despite the lack of meaningful articles in the industry (the last useful articles we found were from 2020). Banking organizations are still working towards a better customer experience. Whether it’s a wholesale re-platforming effort or an iterative improvement across legacy systems, there’s still more to do for financial institutions banking (😆) on customer experience to help build a more resilient relationship with their members, customers, and clients.

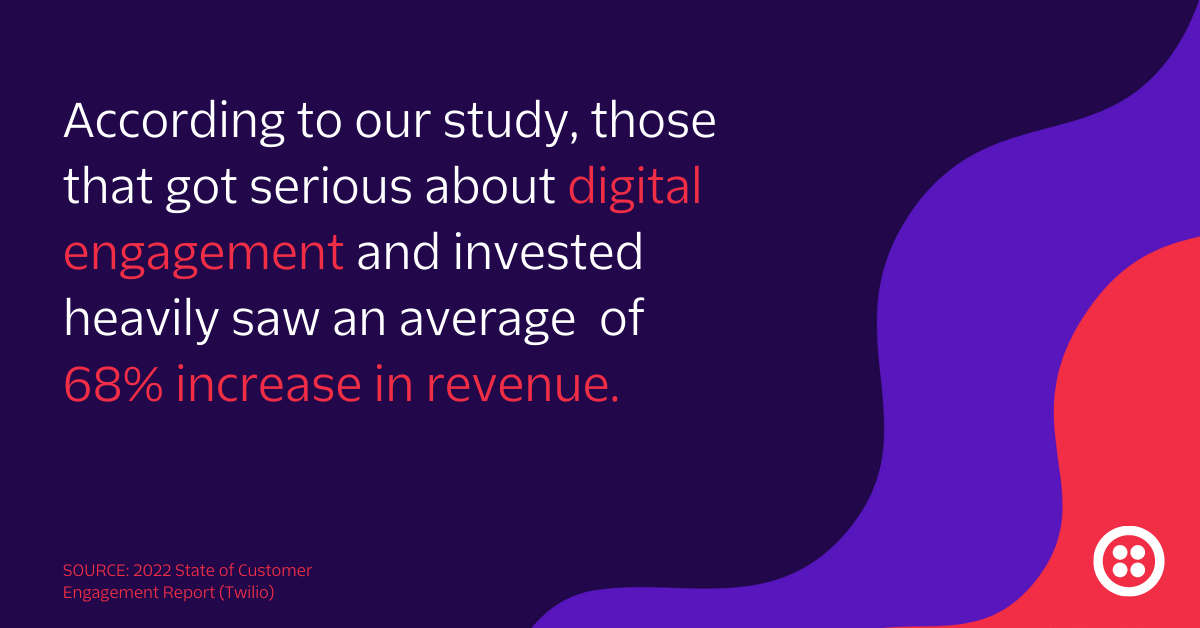

Twilio surveyed more than 2,500 enterprise decision-makers in our State of Customer Engagement Report about how the pandemic has impacted their digital engagement strategies. From that data and additional recent research, we're sharing the engagement trends financial services companies should consider/act on/be aware of in the financial services industry.

The acceleration of digital transformation for the financial services industry

According to our survey, the pandemic accelerated the digital transformation strategies for financial services by an average of 6.5 years. From that, we discovered that there’s good news and bad news. The good news for the industry is seven in 10 companies increased their investment in digital customer engagement in 2021, with financial services being one of the most responsive groups to this shift. The bad news is that it’s not going fast enough for consumers, according to The Financial Brand:

“The pandemic certainly did lead to big advances in the usage of digital banking, as well as many new customer-facing innovations. Yet two factors have slowed the momentum: the need to change processes and technology end-to-end within banks and credit unions, and the fact that consumer expectations don’t stand still, but keep moving upward.”

For those organizations that are going beyond “keeping the lights on,” the impact is impressive.

This aligns with the customer sentiment as well. Seventy-seven percent of consumers say they would be willing to spend more money with a company if they could provide a “good” digital customer experience.

What now?

The powerful potential of improved customer engagement

As Harvard Business Review notes, tech-first financial services organizations are relying on customer experience to differentiate themselves from monolith banking institutions. Beyond that competitive pressure, the banking industry is motivated to shift the customer experience to better:

An article by BAI put it succinctly, “it is up to the banks and credit unions to accommodate their consumers where they are in their financial journey.”

If an organization was able to truly meet the customer where they are, what could it look like in action? Let’s check it out.

360° View of the Banking Customer

With the ease of access and richness of customer data, there's a compelling potential to build out rich customer profiles and deliver personalized communication. A unified experience offers organizations the opportunity to deliver meaningful messages through a unified data pipeline. A customer had a baby? Send a nudge to open a college savings account. Did someone receive a direct deposit from a new job? Prompt them to consider opening a ROTH IRA. Newlyweds open a new account together? Consider referring them to an insurance partner to update their coverage.

Customer-first Communications

The balance between maintaining compliance and optimizing customer experience is always a tightrope to walk when it comes to evolving communication channels. Being able to build a secure, yet connected, relationship with consumers across all channels means connecting to a source of truth. Seamless technology that gathers data from each spoke of your customer service channels to the main hub can help build trust and improve retention with banking customers. Think of it as an old-time-y wagon wheel from your favorite VGA, floppy-disk-driven game, Oregon Trail.

Super Self-Service

Thanks to the pandemic (thanks, pandemic…? 🤷), there are more self-service options than ever. We’ve seen contactless banking, transforming branch locations, and increased video options emerge to help people and employees feel safe. Financial management is on the customer’s terms more than ever. With changing customer expectations, banks need to continue to evolve so as to respond to customer needs. Financial industry evolution would benefit from partnering with technology vendors that can flex with your unique needs to ensure a custom experience for your organization.

Better Compliance, Account Security, and Authentication

More than three-quarters of the US population are managing their finances digitally according to Business Insider article “US digital banking users will surpass 200 million in 2022”. Thirty-one percent of banking customers have dealt with data security issues, according to Quantum Metric’s recent retail banking survey. These are just two data points impacting the ever-rising consumer awareness about their data and potential liability when managing their finances online. Data compliance, account security, and authentication are more important than ever. Financial institutions need to remain compliant and protect customer information to reduce their risk while also providing customers with a friction-free customer experience that ALSO creates demonstrates their vigilance. No big deal, right? Easy peasy (🍋). Best-in-class financial organizations that build flexible layers of security into their technology stack will be able to fortify even the creakiest of legacy systems with modern protection that will reduce risk and improve reputation.

What are some barriers to these advancements in finance?

Challenges to delivering an effective financial customer experience

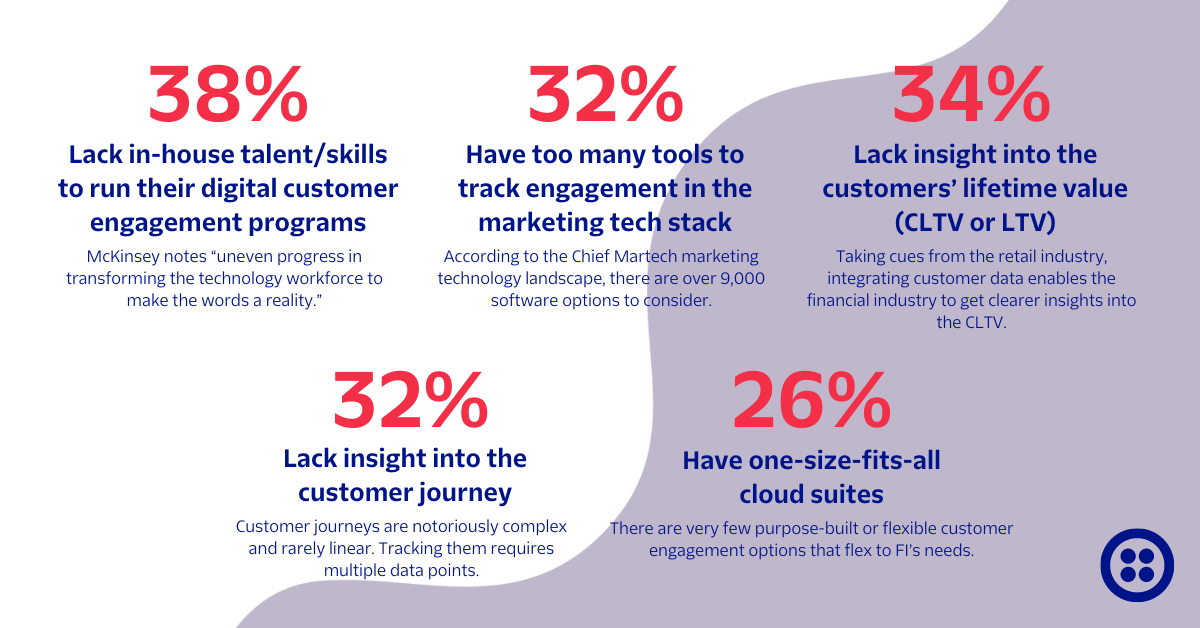

Historically, there were two primary barriers to digital transformation efforts for the financial services industry: a lack of engineering support and a reluctance to replace legacy software. But that all changed with the pandemic. The financial services industry invested like never before to meet urgent needs–– adding more net-new digital channels than the healthcare and retail industries, respectively.

But adding digital channels to adapt business, operations, and services has meant confronting a new set of roadblocks. Let’s see what they are:

Technology-enabled customer engagement is in its infancy. In the past, banks have relied on one-way communications. As communications strategies evolve, there are bound to be a few bumps in the road. Banks across the spectrum of digital maturity are upgrading their experiences. See how NatWest helped implement a Twilio solution that reimagined their customer experience to include robust and adaptable customer communications.

As the industry progresses and the solutions become clearer, there are exciting new opportunities for the financial services industry.

The future of digital engagement in financial services

Much in the way that we discovered that cold calling as a sales tactic was a dying art (90% of customers simply won’t answer their phones anymore according to a Twilio Zipwhip study), we’re finding that face-to-face interaction with bankers is no longer necessary, or desired by most. Consumers say that they want half of their interactions with brands to be digital by 2025. Organizations are heeding the call. Within the financial services realm, organizations anticipate that 65% of their organization’s customer engagement will be digital by 2025.

With the future of engagement for financial services heading online, trust challenges will continue to break through the barriers of good customer relationships like the Kool-Aid Man™ busts through a wall at a kid’s party in the classic 80s commercials. The industry is well aware of the importance of first-party data in the quest for building trust and enhancing the customer experience. Ninety-five percent of financial service organizations indicated how the insights they will glean from that data can help craft a better customer experience. Yet, only 43% are prepared for the impending cookieless future (coming to you in 2025 📺) as Google, Safari, and Firefox shift away from third-party cookies.

To help solve this challenge amongst the others outlined above, financial industries expect their investment in digital customer engagement to increase to an average of 84%.

Digital transformation and building the future of digital finance

The financial industry has quickly gone from a vertical with inflexible and monolithic technology systems and processes to one of the fastest responding industries when it comes to digital transformation. This paints an exciting picture of the future. It comes just in time for the unprecedented demand for digital services. The engagement that customers seek requires a flexible communication structure to help support existing technologies as well as the growth that will be necessary to keep up.

Do you recall the wagon wheel we referred to earlier with the hub and spokes? Start thinking about how that metaphor might help financial service providers bring together all of their data from across the business to understand each customer. The opportunity to personalize their experience in real-time and equip every customer-facing team with the clarity and understanding this data provides is evocative.

Today, the technology exists to engage every customer, on their channel of choice in a secure way. All the financial services industry needs to do now is empower the customer-first strategies organizations have been carefully crafting with customer engagement platforms that allow them to build and grow trusted customer relationships at scale.

What’s next?

Maureen Jann is a Senior Content Marketing Manager at Twilio. She has over two decades of experience as a marketer and has helped fintechs, financial service organizations, and healthcare organizations level up their marketing strategies. Maureen has a Bachelor's of Art from San Jose State, and an MBA from the School of Failed Startups. She is a frequent speaker and guest writer for popular marketing industry organizations and lives in the Pacific Northwest with her husband, daughter and dogs.

Related Posts

Related Resources

Twilio Docs

From APIs to SDKs to sample apps

API reference documentation, SDKs, helper libraries, quickstarts, and tutorials for your language and platform.

Resource Center

The latest ebooks, industry reports, and webinars

Learn from customer engagement experts to improve your own communication.

Ahoy

Twilio's developer community hub

Best practices, code samples, and inspiration to build communications and digital engagement experiences.