A Look at the Fragmented Landscape of IoT Connectivity

Time to read: 8 minutes

While use cases for IoT abound and deployments are growing rapidly, the technology landscape can still be overwhelming to newcomers. This article gives an overview of wireless connectivity protocols and their respective strengths, weaknesses, and recommended fields of application.

The ever-expanding IoT

Enterprises and government agencies are leveraging Internet of Things (IoT) technology to maximize efficiency and reduce operating expenses while improving service delivery to their constituents. By implementing connected solutions, IoT is driving advancements across a wide variety of vertical industries, including utilities, connected vehicles, agriculture, healthcare, transportation, and security for businesses and homes. IoT is also driving new opportunities for innovation – solving problems while delivering global economic and environmental change.

The growth in IoT over the past few years and its future market potential are both impressive. The market intelligence firm International Data Corporation (IDC) estimates IoT spending was approximately $742 billion in 2020. Looking forward, IDC’s Internet of Things Spending Guide expects global IoT to achieve a compound annual growth rate (CAGR) of 11.3% over the 2020-2024 forecast period.

Wireless IoT connectivity options

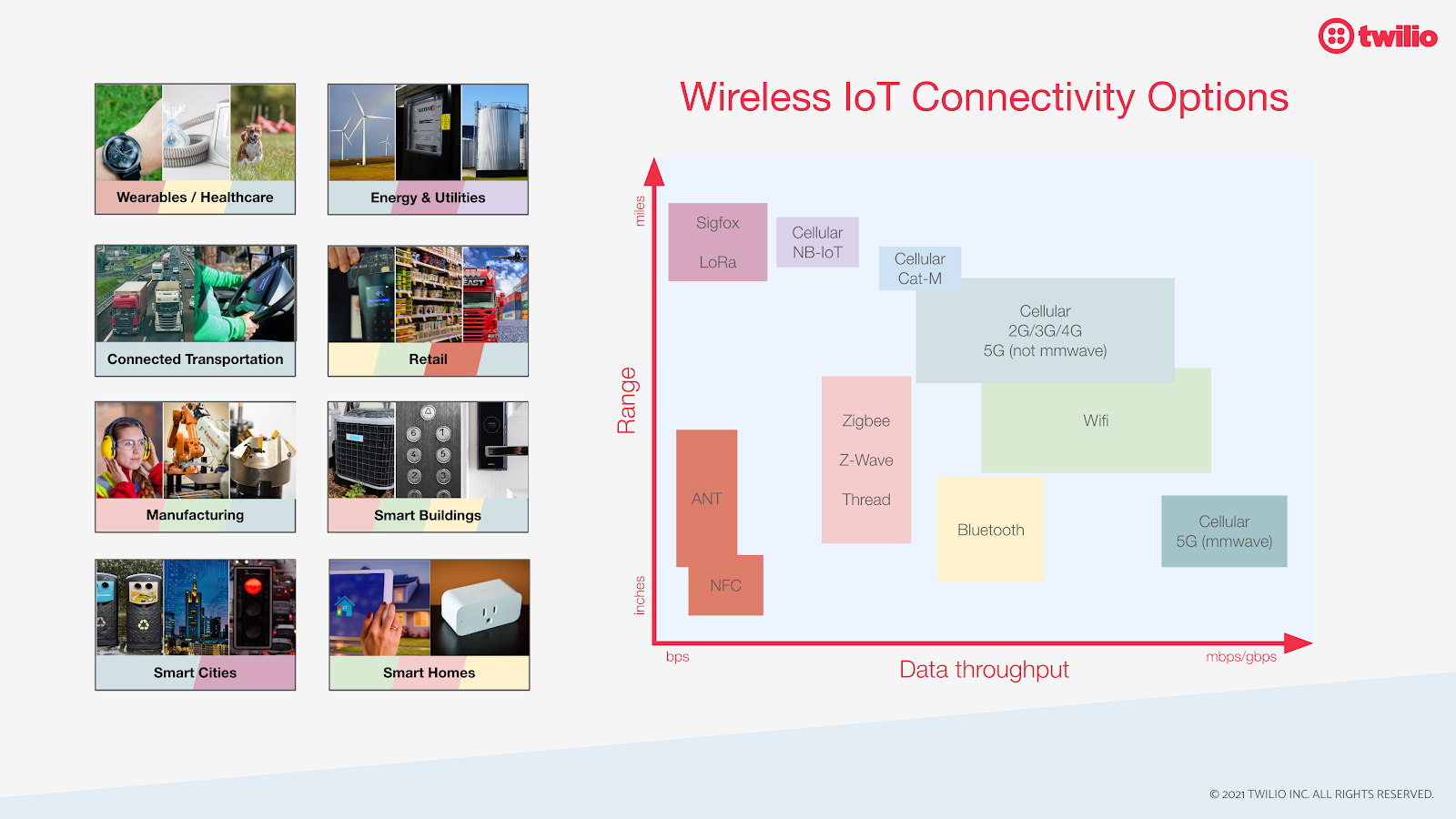

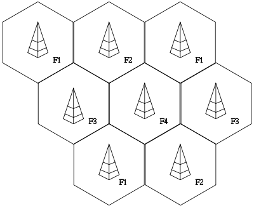

When it comes to connecting devices, the networking technology landscape remains complex and fragmented with no one-size-fits-all protocol capable of addressing all IoT use cases. Each connectivity option has trade-offs between power consumption, bandwidth, and range, as the following diagram shows:

Due to the overwhelming variety of options (and array of acronyms), it can be a struggle to select the appropriate wireless connectivity solution to deploy for specific vertical market use cases.

To help make sense of this connectivity conundrum, here is an overview of the top six wireless categories, detailing their unique advantages/disadvantages, power consumption, range and bandwidth capabilities.

Short-Range Solutions

The following three IoT connectivity options transfer data over small distances – usually less than 150 meters between the “thing” that collects the data and the hub or gateway that processes the data or sends it over the internet to another (often cloud) platform for processing.

Wi-Fi

Although critical in providing high-throughput data transfer in both enterprise and home environments, in the IoT space Wi-Fi has limitations as to coverage, scalability and power consumption. For consumers, it is mostly used with smart home gadgets, appliances, and security cameras that connect to power outlets and directly to the internet.

Wi-Fi is a good choice for office environments and smart factories where sensors monitoring the efficiency of production send data frequently, but limited to a relatively small physical range. While technically suited for use in smart offices and similar corporate or public spaces, IT departments often do not allow IoT devices on their networks for security reasons.

Bluetooth/BLE

Like Wi-Fi, Bluetooth technology is capable of sending data continuously, but works within an even shorter range (usually less than 10 meters). Bluetooth was originally intended for point-to-point or point-to-multipoint data exchange among consumer devices.

Optimized for power consumption, Bluetooth Low-Energy (BLE) was later introduced to small-scale consumer IoT applications, such as fitness and medical wearables, smart home devices, as well as beacons. Often the data is conveniently communicated to and visualized on smartphones.

Mesh Networks (Zigbee, Z-Wave, Thread)

These solutions are deployed using a mesh topology to extend coverage by relaying sensor data over multiple wireless sensor nodes that are distributed in close proximity. Powered nodes cooperate in the distribution of data. Zigbee and similar mesh protocols (e.g., Z-Wave, Thread) operate best within a medium physical range (less than 100 meters).

Mesh network connectivity is most commonly used for wireless control and monitoring applications in the smart home or smart building space, like connected lighting, HVAC controls, smoke and CO2 detectors, security and energy management.

Long-Range Solutions

Low-Power, Wide-Area Network (LPWAN) is an umbrella term for any network that allows communication over long distances (at least 500 meters of signal range from gateway device to endpoint) and uses minimal power. They are best suited for use cases that send small and infrequent amounts of data that are not overly time-sensitive, such as smart utility metering, asset tracking, smart agriculture, environmental monitoring, facility management, occupancy detection and consumables monitoring. LPWAN connectivity breaks down into two categories: unlicensed and licensed frequencies.

Unlicensed LPWAN (LoRaWAN, Sigfox)

Approximately 25 different LPWAN technologies use unlicensed frequencies, yet LoRaWAN and Sigfox have emerged as the clear leaders in this arena.

LoRaWAN is a long-range LPWAN specification developed and maintained by the LoRa Alliance, a non-profit with over 500 global member companies. LoRaWAN architecture utilizes gateways that relay messages between end-devices and a central network server. It can be deployed as a private network or offered as a public network through integrators. Although based on an open standard, LoRa devices from a variety of manufacturers rely on chip technology from the US-based company Semtech.

Sigfox, on the other hand, is a single company in France that developed a patented, proprietary technology. Sigfox rolls out and maintains its own network, sometimes through partnerships, and profits directly from subscription to the network. Currently, Sigfox is more popular in the EU region than in the US.

Non-cellular unlicensed band technology can serve some organizations better than the following cellular options because they are less expensive, but these LPWANs often perform slower and are less reliable than standard licensed cellular technology.

The term “cellular”, by the way, refers to the land areas over which cellular networks are distributed, with each area being served by at least one fixed-location transceiver; these land areas are called “cells”.

Licensed LPWAN (LTE-M, NB IoT)

The big advantages of using a cellular LPWAN that is running over a licensed spectrum include higher-quality connectivity, less interference, and fewer dropped connections. Attaching to cellular networks requires a data plan with a Mobile Network Operator (MNO). Organizations primarily have two LPWAN cellular IoT connectivity options to select from: NB-IoT and LTE-M.

Narrowband IoT (NB-IoT) is a standard for licensed LPWAN technology that doesn’t require data aggregation gateways and allows sensor devices to communicate directly to a central server. NB-IoT can support a massive number of low-throughput devices with the ability to penetrate below ground and thick concrete walls for better indoor coverage. NB-IoT is ideal for simple applications using stationary sensors with low power consumption and low bandwidth requirements, including many smart building and smart city applications. It is not uncommon for NB-IoT devices to only send data a few times a day.

The other licensed spectrum cellular LPWAN option is LTE-M (also known as LTE Cat-M1, or simply Cat-M). LTE-M supports higher-bandwidth and mobile devices with lower latency than NB-IoT. Other than NB-IoT, LTE-M is not built for devices that need to be always-on. For always-on use cases, devices should connect to regular LTE (see next section), as carriers tend to remove LTE-M devices from their networks in case of congestion. LTE-M is best suited for real-time mobile applications. These two low-power options are the newest members of the 4G family and will carry over into 5G.

ABI Research predicts that LoRaWAN and Sigfox will hold the leading share of LPWAN connections at least through 2024 over cellular LPWAN technologies NB-IoT and LTE-M. But by 2026, NB-IoT and LTE-M will capture over 60% of the 3.6 billion LPWAN connections. Of the remaining 40% share, LoRaWAN and Sigfox will account for over 80% of the non-cellular LPWAN connectivity.

Broadband Cellular (2G, 3G, 4G, 5G)

In IoT, broadband cellular connectivity mainly includes wide-area use cases that require higher throughput, lower latency and larger data volumes. Broadband has the farthest range by far, offers a reliable and ubiquitous coverage range, yet can take a lot of battery power.

The sunsetting of older 2G and 3G cellular networks is globally underway. There are different shutdown date schedules depending upon region. This situation is creating a significant transition for many companies since these networks are currently the most used for IoT devices. Eventually, 2G and 3G devices will no longer connect to the network and will cease communicating. Now is the time to create an action plan for network migration – including modem selection, to be future-ready – to ensure continued business operations.

The main differences between 4G (including the slightly more advanced LTE) and 5G for IoT are the data rate and latency. The GSMA, the lead industry organization representing the interests of MNOs worldwide, states 5G networks will provide between 10 and 100 times faster data rates, at latencies up to 10 times lower when compared with current 4G networks.

Ongoing broadband releases will continue to improve cellular IoT and push this connectivity option to serve more IoT use cases under one network. MNOs, such as AT&T and Verizon, have already started to deploy the millimeter-wave spectrum of 5G New Radio (NR) technology, which uses higher-frequency radio waves with a shorter range than previous generations of cellular wireless. In addition, part of the upcoming release 17 by the 3GPP (3rd Generation Partnership Project, a group of standards organizations which develop protocols for mobile telecommunications) will introduce a new radio technology called NR-Light, offering higher data throughput and lower latency through smaller packaging, frequency hopping, and longer low-power modes to increase battery life.

5G and its successors, including 6G, with their high-speed mobility support and ultra-low latency, are all expected to open the door to even more IoT innovation and enable real-time video surveillance for public safety, delivery of medical data sets for connected health, and several time-sensitive industrial automation applications in the future.

Turning Cellular IoT into software

According to ABI Research, a global tech marketing advisory firm, there will be 7 times growth of cellular IoT devices through 2026. One of the main drivers for cellular IoT adoption is the fact that it is easy to deploy and scale. Basically, the only requirements are a cellular modem and the ability to host a SIM; this could either be in the form of a slot for a SIM chip, a pre-soldered SIM (embedded SIM), or support for eSIM, which allows remote SIM provisioning over the air. (What is the Difference between eSIM and Embedded SIM?)

Twilio’s Super SIM alleviates the challenges of global connectivity with a single multi-carrier SIM accommodating hundreds of global networks, full control over which mobile networks devices use around the world, support for scale of business across international borders, simple pay-as-you-go pricing, and one predictable monthly bill for everything.

ABI Research estimates at the end of 2020 there were 6.6 billion IoT devices connected and active worldwide. Yet, in many ways, the growth and development of IoT has not achieved some expectations or come close to the popular 2010 forecast of 50 billion connected devices by 2020. Perhaps this is partially due to the complexity of IoT solution development or enterprises lacking the ability to extract enough of the business value from IoT to warrant the investment.

Fortunately, tools are now available to speed time to market and easily manage IoT deployment by transitioning the cellular IoT component into a more developer-friendly software solution, complete with a set of APIs to incorporate fleet management into existing business workflows and backend processes. These solutions make connecting devices to the internet much easier to implement and manage than before – allowing organizations to focus on delivering innovative IoT experiences to customers and producing an amazing ROI for their business.

If you’re interested in trying Twilio’s cellular connectivity to jumpstart your IoT project, sign up to get a free Twilio Super SIM.

Tobias Goebel brings almost 2 decades of enterprise software experience, with roles spanning engineering, product management, sales engineering, and product marketing. In the first part of his career, he worked on defining and evangelizing technology solutions to improve communications with “people.” He now works on defining and evangelizing technology solutions to improve communications with “things” as principal product marketing manager for Twilio IoT.

Related Posts

Related Resources

Twilio Docs

From APIs to SDKs to sample apps

API reference documentation, SDKs, helper libraries, quickstarts, and tutorials for your language and platform.

Resource Center

The latest ebooks, industry reports, and webinars

Learn from customer engagement experts to improve your own communication.

Ahoy

Twilio's developer community hub

Best practices, code samples, and inspiration to build communications and digital engagement experiences.