Announcing General Availability of Twilio Generic Pay Connector

Time to read:

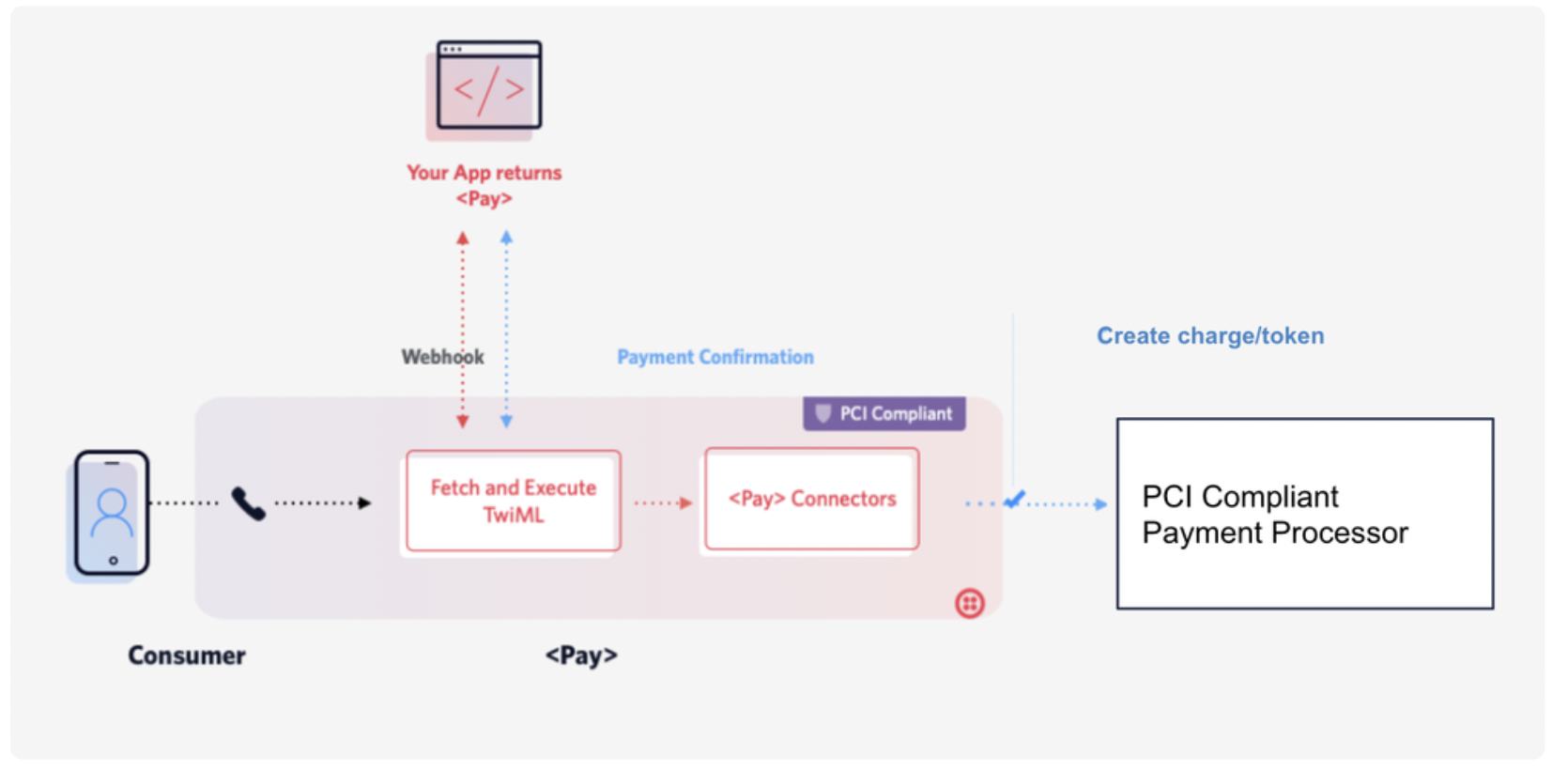

Today, we’re excited to announce that Twilio Generic Pay Connector is now Generally Available. The Generic Pay Connector enables you to capture payments from your customers using Twilio <Pay> and Pay Agent Assist and process them with your payment processor of choice. With Twilio Generic Pay Connector, you can accept payments from your consumers over a phone call in a PCI-compliant manner, reducing your PCI-compliance scope and simplifying PCI compliance data.

When your payment processor of choice is not included in Twilio's list of branded Pay Connectors, Twilio Generic Pay Connector is there for you. Your payment processor is responsible for processing the actual transaction and reporting the result back to Twilio. Twilio relays the result (success/error) of the transaction received from the payment processor back to your application. With this, you can design your payment IVR solution.

We built Generic Pay Connector to serve these segments:

Merchants

- There are merchants who are PCI-compliant, however, they do not have an infrastructure to capture and collect payments from consumers over a voice-call. Furthermore, they may not want to invest in building integrations with their payment processors.

- There are merchants who are limited to no PCI-scope and want to outsource PCI-compliance items because any PCI-scope increase involves work (which can be a massive undertaking for small or medium sized enterprises). Furthermore, they may not want to invest in building integrations with their payment processors.

Payment Processors

- The majority of Payment Processors do not offer a PCI-compliant way of collecting payments over the phone and need offerings like Twilio <Pay>. This also opens up a new marketing channel for acquiring new customers for payment processors.

- As part of an IVR payment process, the two most widely performed transactions are - Tokenize and Charge. Each payment processor may have slight variations on how they define these transaction types. In this respect, we provide payment processors the flexibility to define the setup and type of transaction.

What do you need to know about Generic Pay Connector?

Twilio Generic Pay Connector accepts two payment methods: credit cards and ACH-debit. It performs two transaction types: charge and tokenization.

- A charge transaction means you want to immediately capture funds from the customer's supplied payment method (i.e., credit cards or ACH-debit) in return for the goods or services you offer.

- A tokenize transaction means you want to obtain a token based on the user's supplied payment information (i.e., credit card or ACH-debit information) from the payment processor instead of posting any charge. Tokens are typically stored so that you can charge the user in the future without having to ask for the payment information again. Note that tokens are provided by your payment gateway or processor.

We have also introduced Test and Live modes for Generic Pay Connector. In the Test mode, you can install and configure your connector, plug in your payment gateway URL and test it using test credit card and bank account numbers. When you're ready to go live, raise a support ticket and submit a valid PCI Attestation of Compliance (AoC) document for your payment gateway and a member of our team will review and approve your connector in Live mode to start processing transactions. For more details, check out our docs.

Learn more about the Generic Pay Connector in the docs.

We can’t wait to see what you build!

Related Posts

Related Resources

Twilio Docs

From APIs to SDKs to sample apps

API reference documentation, SDKs, helper libraries, quickstarts, and tutorials for your language and platform.

Resource Center

The latest ebooks, industry reports, and webinars

Learn from customer engagement experts to improve your own communication.

Ahoy

Twilio's developer community hub

Best practices, code samples, and inspiration to build communications and digital engagement experiences.